are salt taxes deductible in 2020

The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately. The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

. The SALT deduction cap. IR-2019-59 March 29 2019. 9 Notice 2020-75 agreeing that pass-through entity PTE.

IRS permits SALT deduction pass-through workarounds. IRS Approves SALT Workaround for Pass-Through Entity Notice 2020-75. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump.

52 rows The SALT deduction is only available if you itemize your deductions. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. The 10000 state and local tax deduction cap was enacted as part of the Tax Cuts and Jobs Act in 2017.

House of Representatives passed the Restoring Tax Fairness for States and Localities Act HR. The IRS released guidance on Nov. The figures for 2020.

The Tax Cuts and Jobs Act of 2017 TCJA limits an individuals deduction for state and local taxes SALT paid to 10000 5000 in the case of a married individual filing a. Using Schedule A is commonly referred to as itemizing deductions. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

The federal tax reform law passed on Dec. IR-2020-252 Before TCJA individual taxpayers normally could deduct all state and local taxes. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

A taxpayer not subject to the alternative minimum taxand therefore able to take SALT deductionswho used to pay 100000 in state taxes could enjoy 100000 in federal tax. The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction.

WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new. The l atest c ase in point is the current push from Democrats to lift the c ap on the federal tax deduction for state and local taxes SALT which would be a massive tax cut for. In late December 2019 the US.

Real estate taxes also called property taxes for your main home vacation. In legislation passed only with. For one thing the law effectively doubled the standard deductionfrom 6000 to 12000 for single filers and 12000 to 24000 for joint filerswith inflation indexing.

In a welcome notice Notice 2020-75 released on November 9 2020 the IRS announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and. There is talk that the SALT deduction limit will be. If Congress does not make.

5377 which calls for the removal of the SALT. However nearly 20 states now.

Internal Revenue Bulletin 2020 15 Internal Revenue Service

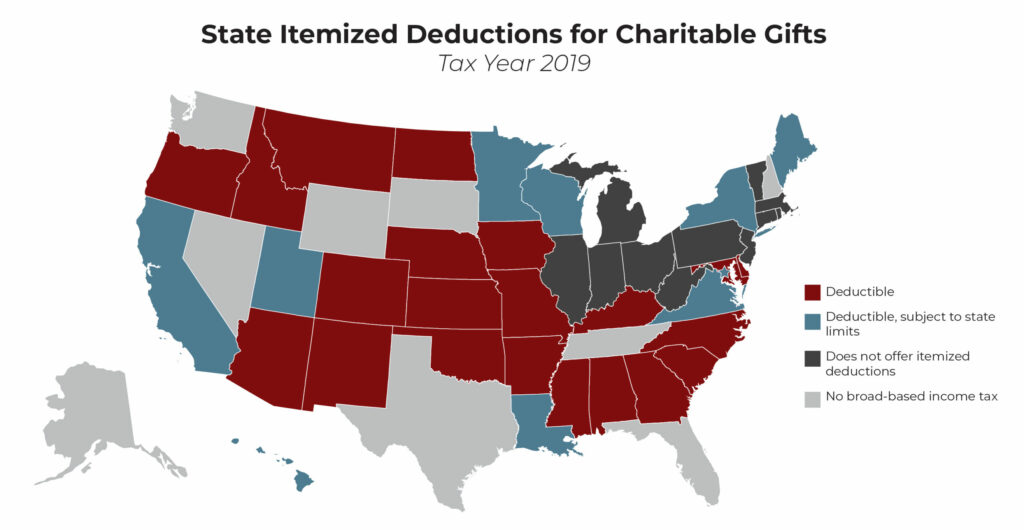

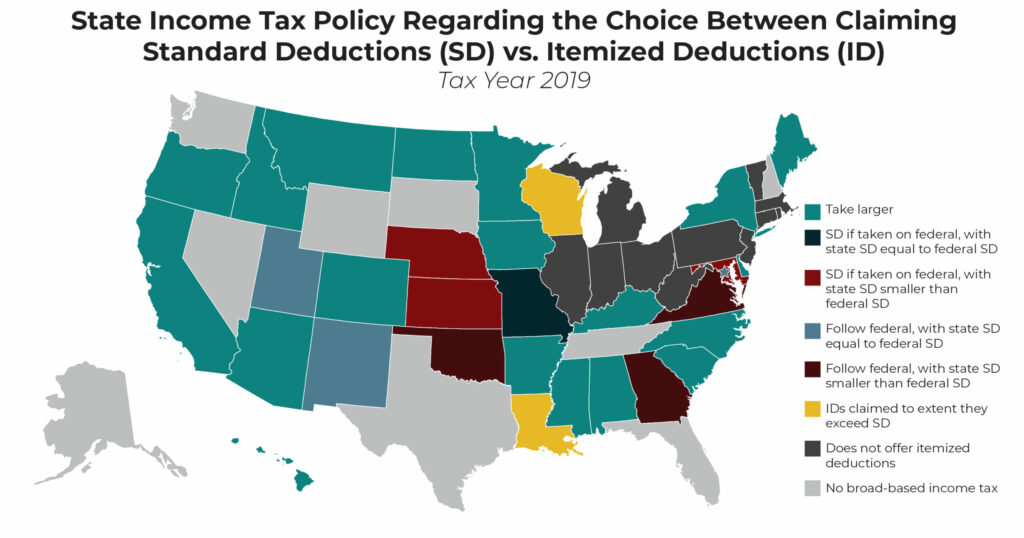

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

Salt Workaround Filing Taxes Throw In The Towel Salt

Can You Claim Gambling Losses On Your Taxes Gambling Party Gambling Problem Gambling

Charity Is Deductible In 2020 Small Gifts Gifts Positivity

_666379219_-_PRPromo-262x151.jpg)

Covid 19 Tax Relief Developments Andersen

Holiday Time Dog Toys Stocking Blue 6 Pieces Walmart Com Dog Toys Holiday Dog Toys Your Dog

Covid 19 Tax Relief Developments Andersen

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

3 Ways To Grow Your Instagram Brand Today Interior Design Business Sales And Marketing Instagram

Internal Revenue Bulletin 2020 15 Internal Revenue Service

_450980272_-_PRPromo-262x151.jpg)